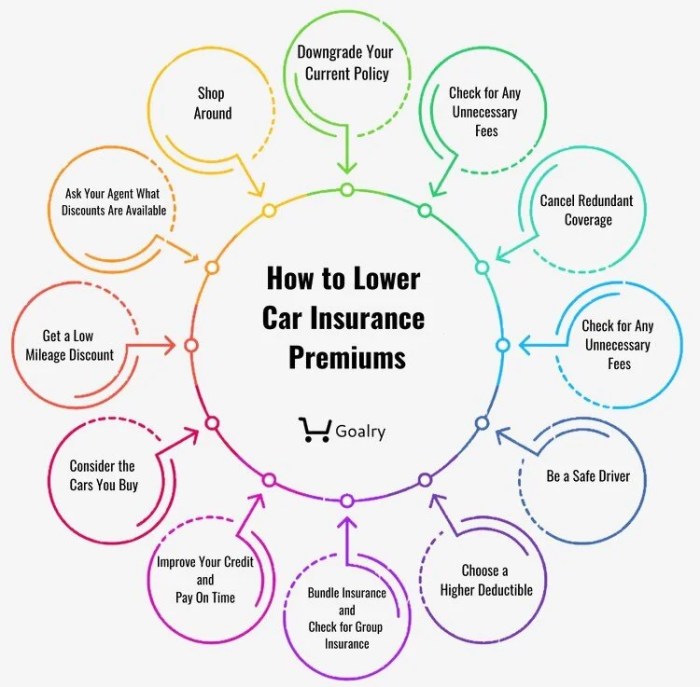

Delve into the world of car insurance premiums with our guide on how to secure lower rates. From research to discounts, we've got you covered with essential tips and tricks to save on your insurance costs.

Researching Different Insurance Providers

When looking to get lower premiums on car insurance, it's essential to research and compare different insurance providers to find the best option for your needs. By taking the time to evaluate various companies, you can potentially save money while still getting the coverage you require.

Checking Customer Reviews and Ratings

Customer reviews and ratings can provide valuable insights into the quality of service provided by insurance companies. Look for feedback from policyholders regarding their experiences with the provider, including how claims were handled, customer service responsiveness, and overall satisfaction. Websites like J.D.

Power, Consumer Reports, and the Better Business Bureau can be good resources for this information.

Evaluating Financial Stability

It's crucial to choose an insurance company that is financially stable to ensure they can fulfill their obligations in case you need to file a claim. One way to assess this is by checking the financial strength ratings of insurance companies from agencies like A.M.

Best, Standard & Poor's, or Moody's. These ratings indicate the insurer's ability to pay claims and meet financial obligations.

Understanding Coverage Options

When it comes to car insurance, it's crucial to understand the different coverage options available to you. This knowledge will not only help you make informed decisions but also potentially lower your insurance premiums.

Types of Car Insurance Coverage

- Liability Coverage: This covers damages and injuries you cause to others in an accident.

- Collision Coverage: This pays for damages to your own car in an accident, regardless of fault.

- Comprehensive Coverage: This covers non-collision related damages, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're in an accident with a driver who has insufficient or no insurance.

Factors Affecting Insurance Premiums

- Driving Record: A history of accidents or traffic violations can increase your premiums.

- Vehicle Type: The make, model, and age of your car can impact your insurance rates.

- Location: Where you live and park your car can affect your premiums due to factors like crime rates and weather risks.

- Age and Gender: Younger drivers and males typically pay higher premiums due to higher risk factors.

Impact of Coverage Limits and Deductibles

- Coverage Limits: Higher coverage limits mean more protection but also higher premiums. Lower limits can reduce premiums but may leave you exposed to higher out-of-pocket costs in case of a claim.

- Deductibles: Choosing a higher deductible can lower your premiums, but you'll have to pay more out of pocket before your insurance kicks in. A lower deductible means higher premiums but less upfront costs in case of a claim.

Maintaining a Good Driving Record

Maintaining a clean driving record is crucial when it comes to reducing your car insurance premiums. Insurance providers often view drivers with a history of traffic violations or accidents as high-risk, which can lead to higher premiums. Here are some tips on how you can maintain a good driving record and lower your insurance costs.

Tips for Avoiding Traffic Violations and Accidents

- Follow traffic laws: Obey speed limits, traffic signals, and road signs to reduce the risk of getting a ticket or causing an accident.

- Avoid distractions: Put away your phone, adjust GPS settings before driving, and focus on the road to prevent accidents.

- Maintain a safe following distance: Keep a safe distance from the vehicle in front of you to avoid rear-end collisions.

- Use your signals: Always use turn signals to indicate your intentions to other drivers, reducing the risk of accidents.

- Practice defensive driving: Anticipate potential hazards on the road, stay alert, and be prepared to react quickly to avoid accidents.

How Defensive Driving Courses Can Help Lower Insurance Costs

Defensive driving courses teach drivers advanced techniques to anticipate and avoid potential accidents on the road. Completing a defensive driving course can not only make you a safer driver but also demonstrate to insurance providers that you are proactive about improving your driving skills

This can lead to discounts on your car insurance premiums. Check with your insurance provider to see if they offer discounts for completing a defensive driving course in your area.

Bundling Policies for Discounts

When it comes to getting lower premiums on car insurance, bundling policies for discounts can be a great strategy to save money. Bundling multiple insurance policies means purchasing different types of insurance from the same provider. This can include combining your car insurance with other policies such as home insurance, renters insurance, or life insurance.

Examples of Common Policies that can be Bundled

- Car insurance and home insurance

- Car insurance and renters insurance

- Car insurance and life insurance

By bundling your policies with the same insurance provider, you may be eligible for a multi-policy discount. This discount can lead to lower premiums overall compared to purchasing each policy separately from different providers. Additionally, bundling can simplify your insurance payments and make it easier to manage your coverage.

Utilizing Discounts and Incentives

Utilizing discounts and incentives offered by insurance companies can significantly lower your car insurance premiums. By taking advantage of these opportunities, you can save money while still maintaining the coverage you need.

Different Discounts Offered

- Multi-policy discount: Save money by bundling your car insurance with other policies like home or renters insurance.

- Good driver discount: Maintain a clean driving record to qualify for lower premiums.

- Safety feature discount: Installing safety features in your car, such as anti-theft devices or airbags, can lead to discounts.

- Low mileage discount: If you drive fewer miles than the average driver, you may be eligible for a discount.

Tips for Qualifying for Discounts

- Regularly review your policy and ask your insurance provider about available discounts.

- Take defensive driving courses to improve your driving skills and potentially qualify for discounts.

- Maintain a good credit score, as some insurance companies offer discounts based on credit history.

- Consider raising your deductible, which can lower your premiums and make you eligible for additional discounts.

Loyalty Incentives and Premium Reduction

Insurance companies often reward loyal customers with discounts or incentives for staying with them for an extended period. These loyalty incentives can help reduce your premiums over time, making it beneficial to stick with the same insurance provider if they offer such rewards.

Adjusting Coverage Based on Needs

When it comes to lowering premiums on car insurance, adjusting coverage based on specific needs can be a key strategy. By tailoring your coverage to match your individual circumstances, you can potentially reduce costs while maintaining adequate protection.

Reducing Coverage Appropriately

There are certain situations where reducing coverage may be appropriate to lower premiums:

- If you have an older vehicle that may not require comprehensive or collision coverage.

- If you have health insurance that covers injuries resulting from an accident, eliminating medical payment coverage may be an option.

- If you have a reliable emergency fund to cover potential expenses, raising deductibles can lower premiums.

Regularly Reviewing and Updating Coverage

It's important to review and update your coverage regularly to ensure it aligns with your current needs. Life changes such as purchasing a new car, moving to a different location, or changes in driving habits can all impact the type and amount of coverage you require.

Final Review

In conclusion, mastering the art of reducing car insurance premiums is within reach. By implementing the strategies Artikeld in this guide, you can navigate the world of insurance with confidence and savings.

FAQ Insights

How can I find the best car insurance provider for lower premiums?

Research different providers, compare quotes, and check customer reviews to determine the most cost-effective option.

What factors can impact my car insurance premiums?

Factors such as age, driving record, type of coverage, and vehicle make and model can all influence your insurance costs.

Are defensive driving courses worth taking to lower insurance costs?

Yes, defensive driving courses can help reduce premiums by showcasing your commitment to safe driving practices.

How do loyalty incentives work in reducing car insurance premiums?

Insurance companies often offer loyalty incentives to long-term customers, which can lead to discounts on premiums over time.